If the dividend or split does not occur at the same time as some other event that would alter perceptions about future cash flows such as an announcement of higher earnings then one would expect the price of the stock to adjust such. In order to not cause an unjustified increase in the stock price the share value is adjusted by the same ratio as the stock split.

Stock Splits And Stock Dividends Principlesofaccounting Com

A corporate action in which a company divides its Existing Shares into Multiple Shares.

. The main advantages of stock dividends are two-fold. Taken together over the near term a split and a dividend may have a beneficial effect on Midlantics market price. Oct 13 2017 916AM EDT.

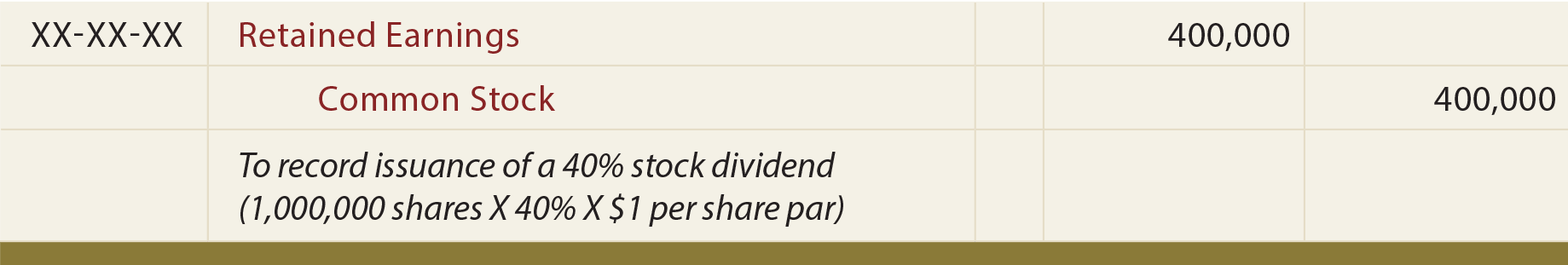

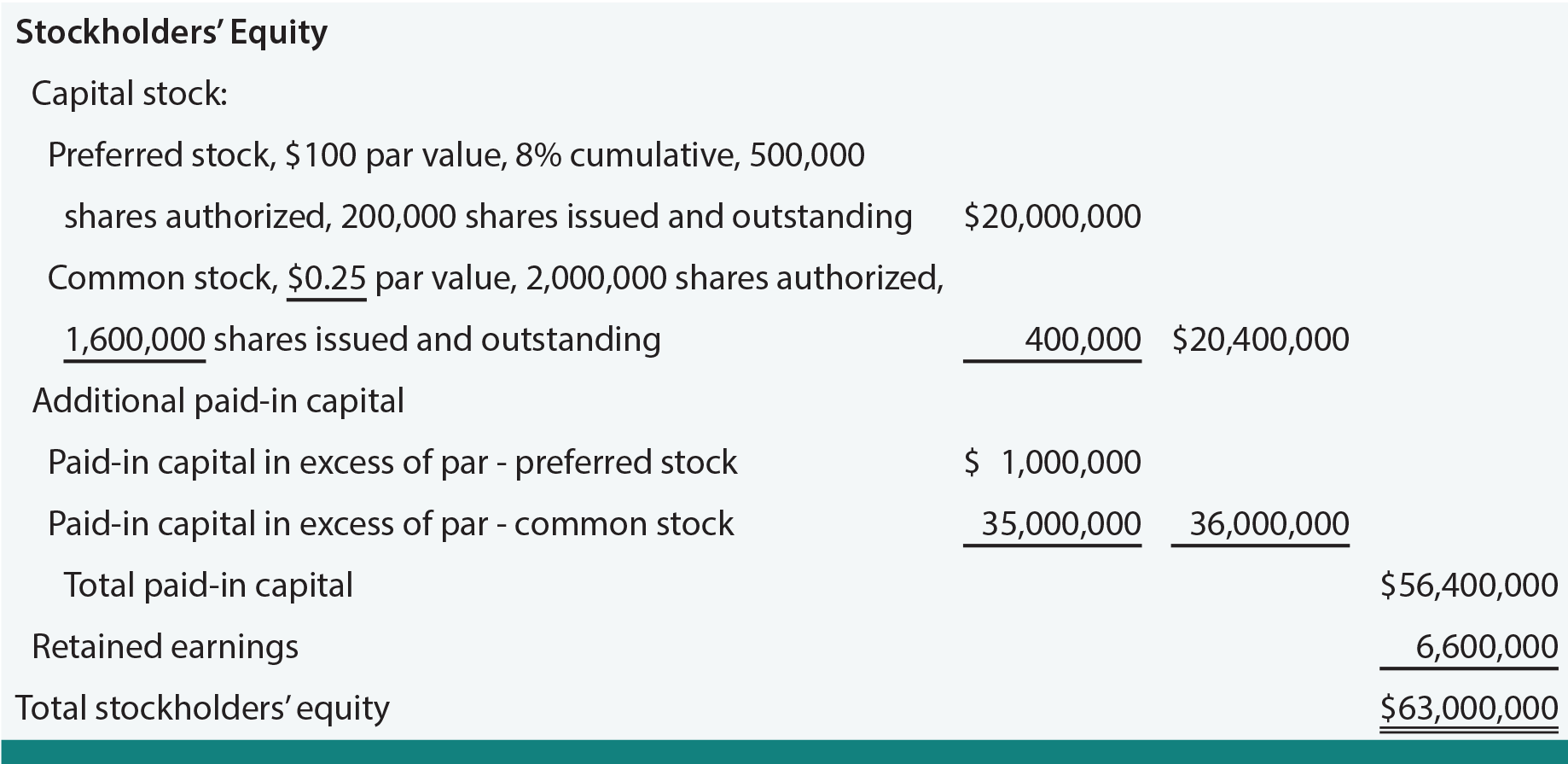

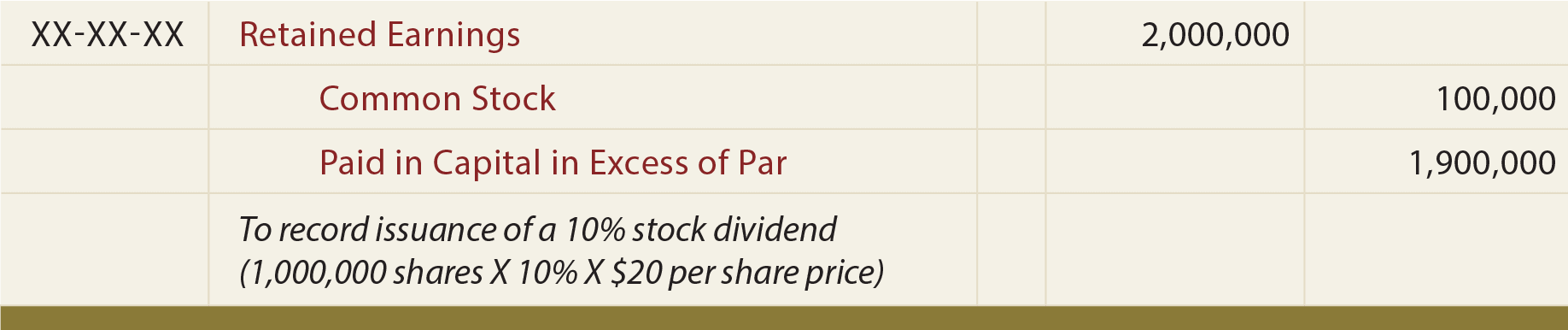

Stock Dividends and Splits Stock splits and stock dividends may be used by a corporation to change the number of shares of its stock outstanding. Cause total stockholders equity to remain the same. Cause the par value per share to change - stock splits and stock dividends.

October 13 2017 616 AM. Match stock splits and stock dividends with their characteristics stock splits-cause the par value per share to change stock splits and stock dividends-cause. The Motley Fool.

The advantage to the shareholders receiving the dividend is that the Internal Revenue Service IRS treats stock dividends as stock splits. We provide opinion articles detailed dividend data history and dates for every dividend stock screening tools and our exclusive dividend all star rankings. A stock split is an action taken by a company to divide its existing shares into multiple shares.

So what is a stock split. The common stock dividend should be considered at the same time as a stock split. Solutions for Chapter 16 Problem 2C.

When a company splits its stock the number of outstanding shares owned by investors increases. A stock split is a corporate action taken to renew investor interest by dropping the price of a share if its too high and increasing liquidity to theoretically have a positive impact on the share price at least in the short run. From an accounting viewpoint explain how a stock split effected in the form of a dividend differs from.

W hen a company splits its stock the number of outstanding shares owned by investors increases. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a. Both stock dividends and stock splits increase the number of shares outstanding and in effect cut the pie into more but smaller pieces.

Simply put a stocks dividend per share will be reduced as a result of a stock split but the total. Therefore the investors do not incur any tax liability for the year in which they received the stock dividend distribution. Although the number of shares outstanding increases by a specific multiple the total value of the shares remains the.

Existing shareholders would see their shareholdings double in quantity but. A stock split calendar showing the recent and upcoming stock splits. Match stock splits and stock dividends with their characteristics.

Stock Splits After the Record Date. Explain what is meant by a stock split effected in the form of a dividend. For example if you own 50 shares in a company that completes a 2-for-1.

Stock Splits and Stock Dividends. Terms in this set 48 Select all that apply. Stock splits are events that increase the number of shares outstanding and reduce the par or stated value per share.

For example if you own 50 shares in a company. What stock splits mean to your dividends. Assume ABC Corp has 10 million shares outstanding and are trading for 100.

Stock Dividends and Splits. The old stock price of 100 per share now becomes 20. Answer 1 of 8.

For example a two-for-one stock split would double the number of shares outstanding and halve the par value per share. Stock splits - Cause the par value per share to change. During the time that they held the stock it went through a 51 stock split entitling them to 5 new shares for every 1 share they held.

In addition to its value as a positive signal to the market a. Match stock splits and stock dividends with their characteristics - stock splits. This video explains the calculations related to dividends stock splits and stock repurchases.

A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders.

What Is The Difference Between A Stock Dividend And A Stock Split Quora

0 Comments